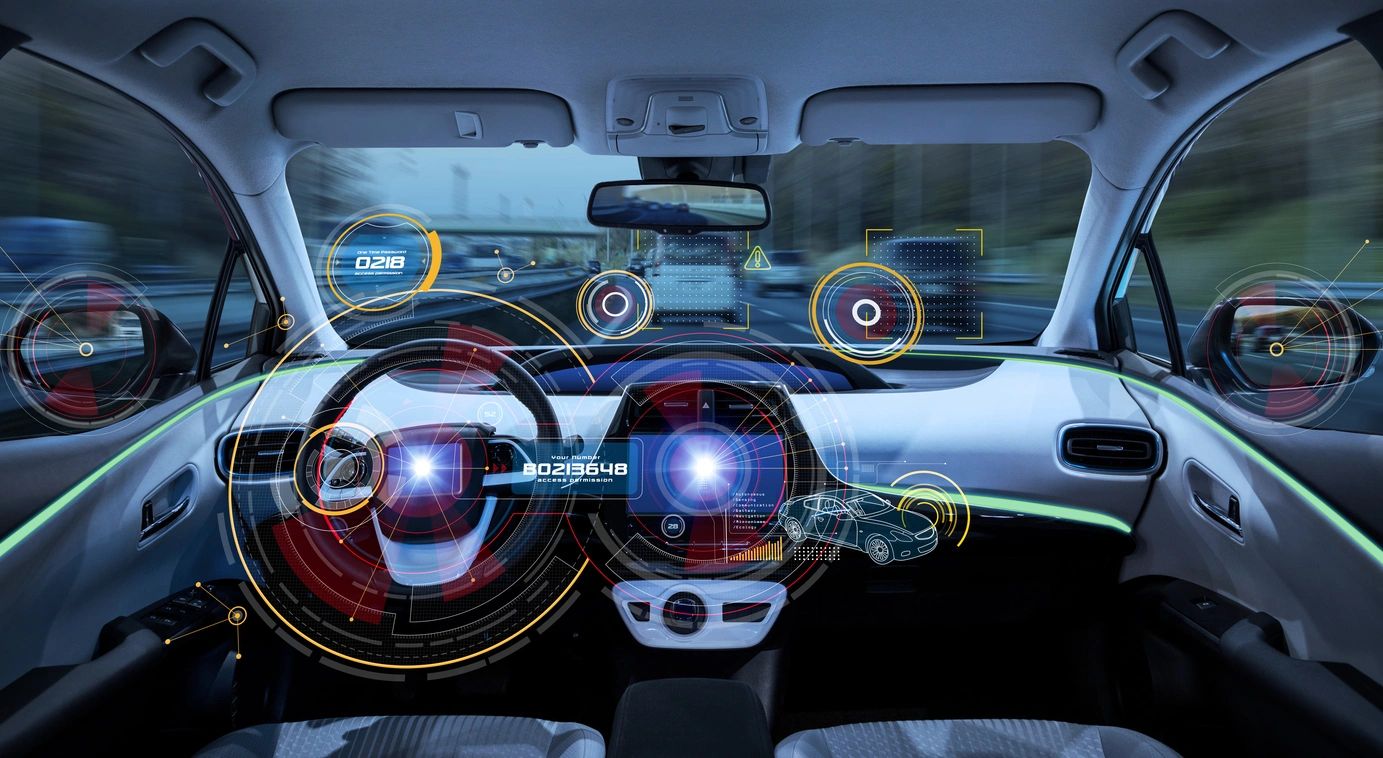

In the world of insurance, “real-time” used to mean a few hours or maybe same-day processing, if you were lucky. However, thanks to telematics and the Internet of Things (IoT), we’re now far beyond that.

Real-time is actually instantaneous, and underwriting is finally catching up to the speed of the rest of the digital world. Two things are driving the shift: data and connectivity.

Telematics: Not Just for Tracking Fleets Anymore

Telematics initially emerged as a means for commercial fleets to monitor vehicle location, fuel consumption, and driver behavior. It was about logistics, not underwriting.

Then, someone had a brilliant idea: what if that same driver behavior data is used to price auto insurance more accurately? Boom, Usage-Based Insurance (UBI) was born.

Now, with a plug-in device or mobile application, insurers can see how often someone slams the brakes, how fast a driver takes corners, and how late someone drives at night. Forget credit scores or ZIP codes – this is pricing based on actual risk in real-time.

It feels fairer to consumers while carriers receive fewer surprises and tighter loss ratios.

IoT: Beyond the Car, Inside the Home and Everywhere Else

Telematics works great for cars, but what about homes and businesses? IoT has filled that gap.

Smart smoke detectors, water leak sensors, security cameras, and thermostats are just a few of the connected devices that tell stories insurers want to hear. With IoT, underwriters no longer have to guess whether a homeowner maintains his or her property.

Insurers know if the pipes froze last winter or if the HVAC system is overdue for maintenance, as IoT provides the data. In commercial spaces, it’s about real-time temperature monitoring in restaurants or motion sensors in warehouses.

It’s about catching minor problems before they turn into claims by transforming a policyholder’s home or business into a giant feedback loop of real-time data.

What Real-Time Underwriting Actually Looks Like

In the old model, if someone applied for auto coverage, underwriters pulled reports, crunched data, and hoped it was good and relevant data until the next renewal. Now, insurers can pull telematics data within minutes, even while the application is in progress.

They compare the applicant’s driving patterns against historical claims data and adjust the quote in real-time. Homeowner underwriters use your smart leak sensor to determine if you’ve caught a dripping pipe and fixed it quickly, potentially lowering your risk score and premium in the next renewal cycle.

Underwriting is shifting from fixed data snapshots to living, breathing profiles that evolve over time.

But, Is This Creepy or Cool?

That depends on who you ask. Some folks love the idea of proving their low risk and getting rewarded for it.

Others don’t want an insurance company knowing how often they hit the brakes or when they leave their house. Privacy concerns are real, and insurers who wish to use telematics and IoT data must be upfront about what they’re collecting, why, and how it’ll be used.

Transparency and opt-in options are key to building trust.

What This Means for the Industry

This shift isn’t just about faster underwriting, it’s about smarter insurance across the board. Telematics and IoT open the door to:

- Dynamic pricing based on actual behavior

- Proactive risk mitigation before claims happen

- Better customer engagement through real-time feedback

- Reduced fraud, thanks to continuous verification

Insurers that lean into this technology are proactive partners, rather than reactive responders, for their clients. And in a world where risk is increasingly complex and unpredictable, that’s a serious advantage.

Telematics and IoT are revolutionizing the underwriting process from the ground up. Real-time insights deliver more accurate pricing, better risk management, and fewer “uh-oh” moments after policy issuance.

The challenge now is responsible use of technology, data protection, and communicating value to consumers. If we get this right, underwriting may feel less like guesswork and more like science.

And honestly, it’s about time. Welcome to the future of insurance that runs at the speed of now.

Agility Holdings Group (AHG) invests in innovative InsurTech, HealthTech, and related companies that aim to revolutionize access to insurance products, establish patient care, and improve health outcomes. Please visit our LinkedIn page for more information about AHG.