How to Use a CRM Without Losing Your Mind or Your Leads

CRMs don’t always live up to their value. They’re supposed to help you keep track of leads, streamline follow-ups, and make business life easier. But sometimes, it feels like they were designed by someone who’s never marketed anything. If you’ve ever stared at a CRM dashboard thinking, “What am I looking at?” you’re not alone. […]

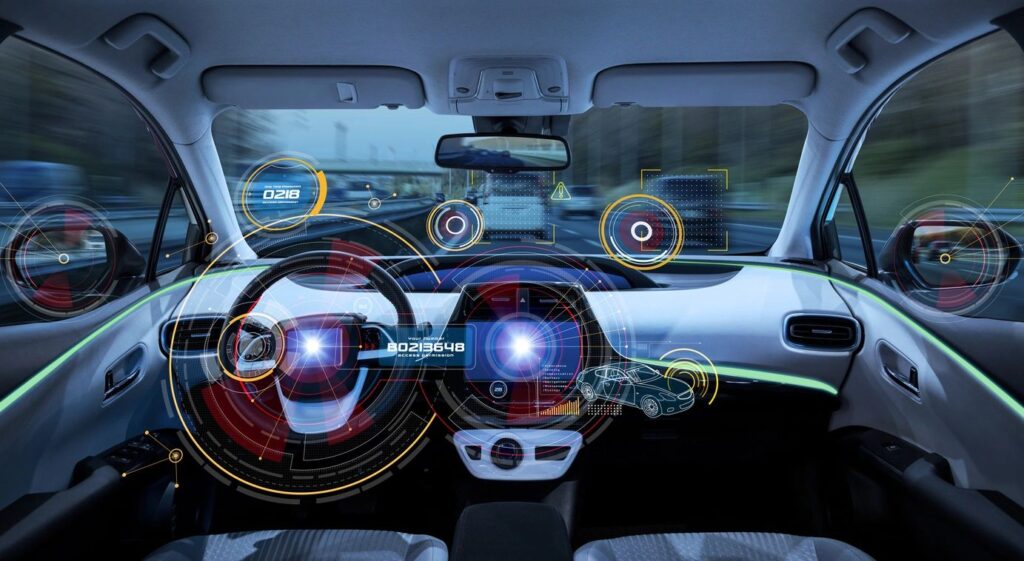

Using Telematics and IoT for Real-Time Underwriting – The Future Is Now

In the world of insurance, “real-time” used to mean a few hours or maybe same-day processing, if you were lucky. However, thanks to telematics and the Internet of Things (IoT), we’re now far beyond that. Real-time is actually instantaneous, and underwriting is finally catching up to the speed of the rest of the digital world. […]

AI for Fraud Detection – How It’s Catching What Humans Miss

The new MVP in insurance crime-fighting isn’t a detective, but an algorithm. Fraud has long been a thorn in the side of the insurance industry. From faking injuries to staging car accidents, scammers have always found creative ways to cheat the system. No matter how skilled human investigators are, they can’t keep up with the […]

Ethical AI in Insurance – Bias, Transparency, and Accountability

There’s no question that Artificial Intelligence (AI) is revolutionizing insurance by processing claims faster, generating more accurate price quotes, and catching fraud that would slip by human eyes. All that shiny technology comes with significant responsibilities. When AI gets it wrong, however, real people pay the price. That’s why the conversation about ethical AI in […]

The Power of Big Data in Modern Risk Assessment and Insurance Marketing

We’ve all heard the phrase “data is the new oil,” and while it might sound like a buzzword, there’s truth to it, especially in the insurance world. These days, big data is doing way more than just filling spreadsheets. Big data enables insurers to understand risk more precisely, market more effectively, and ultimately make better […]

The Future of Personalized Insurance – How AI Is Powering Usage-Based and On-Demand Policies

Remember when insurance was the same for everyone? You’d fill out a few forms, get a quote, and pay the same monthly rate whether you used the policy. That model has quickly gone out of style, thanks mainly to Artificial intelligence (AI). AI is reshaping insurance from a slow, set-it-and-forget-it process to something fast, flexible, […]

Real-Time Data Processing – The Future of Claims Accuracy and Marketing Data

Insurance has always been about information—collecting, analyzing, and acting on it. The days of waiting for end-of-month reports or manually reviewing piles of paperwork are fading rapidly in the face of a rapidly changing world. Thanks to real-time data processing, insurance companies can now act instantly to boost claims accuracy and make marketing brighter than […]

AI in Fraud Detection – Fighting Crime with Code

Fraud in the insurance world isn’t a new phenomenon. For decades, people have faked injuries, exaggerated damages, or even staged elaborate scams. But what is new is the technology we’re using to sniff it out, and at the center of that effort is artificial intelligence. AI isn’t just for writing poems or self-driving cars. It’s […]

Chatbots and Virtual Assistants – The New Frontline of Insurance Customer Service

Remember when calling your insurance company meant sitting on hold forever, listening to elevator music, and praying anyone would finally pick up? Well, those days aren’t entirely gone, but they’re quickly fading thanks to a new wave of digital helpers: chatbots and virtual assistants. If you’ve filed a claim, asked a billing question, or even […]

Predictive Analytics – The New Crystal Ball for Insurers

If you’re in the insurance industry, you know this is a business of managing risk. Wouldn’t it be nice to see risk before it shows up on your desk? This is where predictive analytics can help. This is now a real, usable technology available to most insurance organizations. It delivers instant risk management by identifying […]